Suggested Search

Super is a long-term investment, and everyone has their own unique retirement goals. That’s why FirstChoice Wholesale Personal Super has over 190 investment options to choose from that suit different investment strategies and risk appetites.

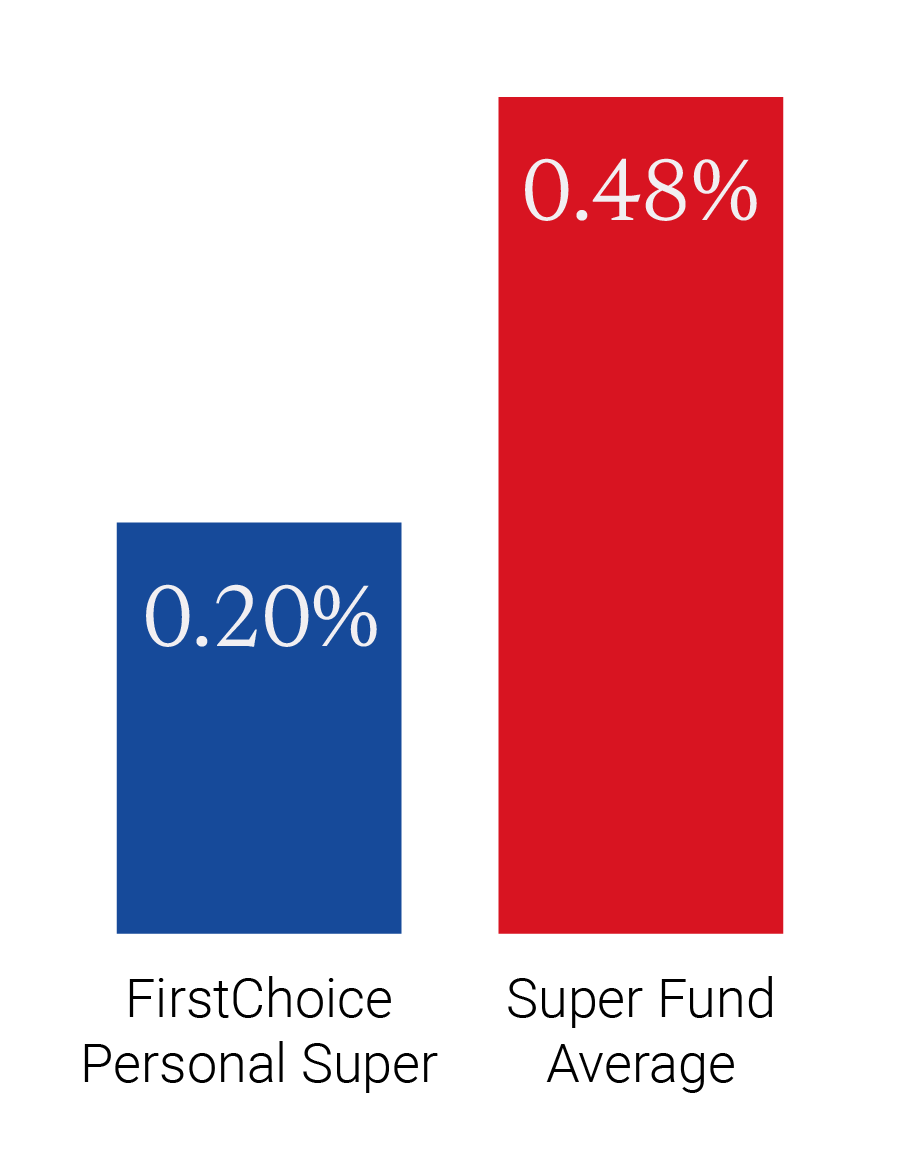

One of the lowest admin fees in the market

Our low admin fees mean more money in your super to give you greater value and great returns in your second half.

Comparison of admin fees by super balance

Important information and assumptions

Administration fees of FirstChoice Wholesale Personal Super options (excluding FirstRate options) for a member balance of $50,000, is 0.20% p.a. effective June 2024. It does not take into consideration investment fees and costs or transaction costs. Please see the PDS for these fees and costs. Super fund Average admin fees are based on the Chant West Super Fund Fee Survey at December 2024 that compares average fees by segments and across four investment risk categories.

Chart constructed by CFS using data sourced from the Chant West Super Fund Fee Survey, effective December 2024, is based on information provided to Chant West by third parties that is believed accurate at the time of publication. Fees may change in the future which may affect the outcome of the comparison. Chant West may make adjustments to fees and costs for comparison purposes and therefore data may vary to other published materials. Consider the PDS and TMD at cfs.com.au to see if it’s right for you.

We’ve helped millions of Australians unleash their second half. If you're not getting enough double-digit returns, we can help.

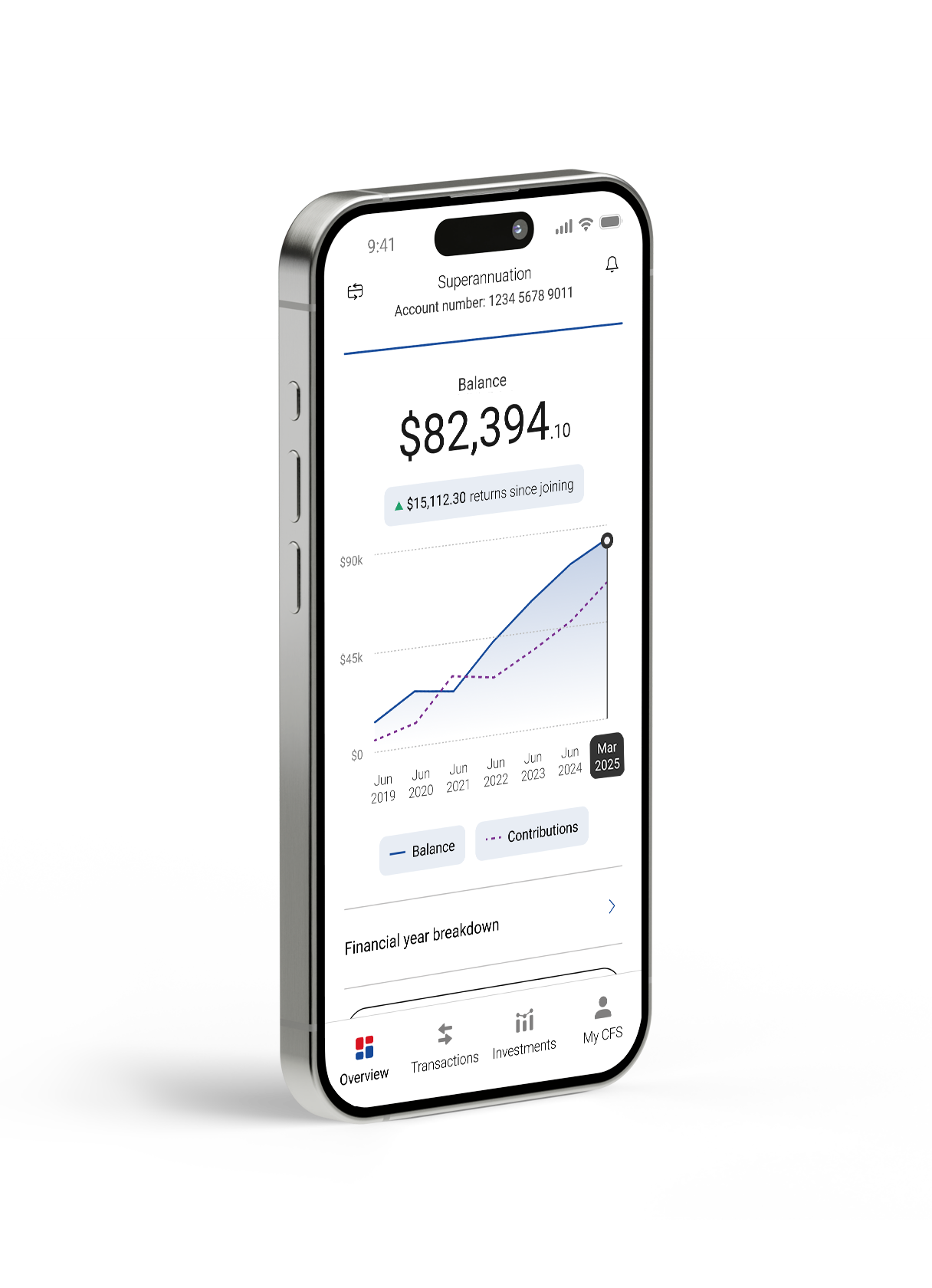

Download our improved app

Discover the confidence that comes with greater knowledge.

With the CFS app, you can easily see how your CFS account is performing thanks to improved charts, graphs and insights.

All of these features paired with faster access to all your information, such as statements, balances, and where your money’s invested - all at your finger tips.

We’re here to help

Compare our performance

and fees

Find out how we stack up against industry averages for performance and fees.

We're here to help

Get in touch

Get in touch with us online or call us 8:30am to 6pm AEST Monday to Friday.

Find the right advice option

Our dedicated team can help you choose from a range of different financial advice options.

Download mobile app

Track your balance and see your transactions history from anywhere.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.