Suggested Search

Know you’re partnering with the best

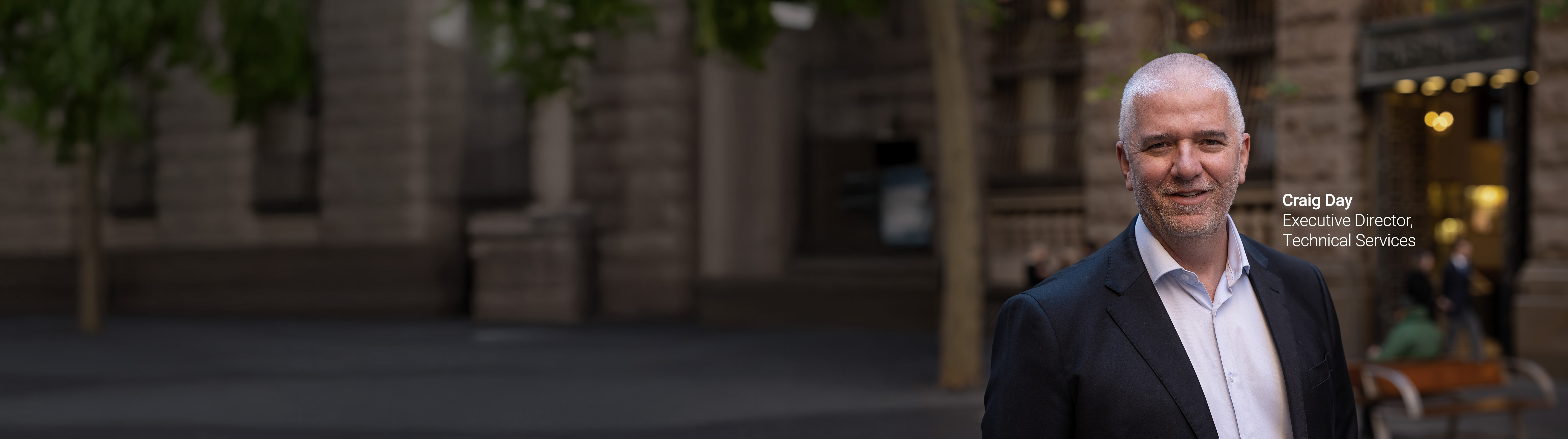

Rated #1 for Technical Support 13 years running by Wealth Insights¹ our FirstTech team brings award-winning expertise to every adviser conversation.

For more than 25 years, our team has offered expert guidance across a wide range of technical areas, from superannuation and contributions, to aged care and estate planning.

Key topic areas

Common tasks

Common tasks

Common tasks

Common tasks

Common tasks

Common tasks

Latest news

Following today's release of the latest average wages data for the December 2025 quarter, FirstTech have calculated the super rates and thresholds for 2026-27.

The ATO is expected to confirm the 2026-27 super rates and thresholds in March 2026.

Key points:

- Concessional and non-concessional contributions caps increase to $32,500 and $130,000

- Non-concessional cap (inc. bring forward rule) - TSB thresholds increase

- General transfer balance cap increases from $2.0m to $2.1m

- Maximum contribution base increases from $250,000 ($62,500 per quarter) to $270,830

Access our 'Super rates & thresholds for 2026-27' for super contributions, super benefits and employment termination payment thresholds.

The Government has announced that social security deeming rates will increase from 20 March 2026.

This is the second increase in deeming rates since 2020, as rates have been frozen at historically low levels.

From 20 March 2026, deeming rates will increase by 0.5% to:

- Lower deeming rate: 1.25% p.a. (previously 0.75% p.a.)

- Upper deeming rate: 3.25% p.a. (previously 2.75% p.a.)

The lower deeming rate threshold is $64,200 for singles and $106,200 for couples combined.

The Government has today (11 February 2026) introduced a new Bill into Federal Parliament relating to Division 296 tax, which seeks to tax the proportion of a member’s super earnings attributable to their total super balance (TSB) over $3m at higher rates. The Bill introduces significant changes to the original proposal.

The changes included in the Bill closely reflect those included in draft exposure legislation released on 19 December 2025, including:

• New two-tier tax on large super balances: Applying an additional 15% tax on earnings attributable to a TSB between $3 million and $10 million, and an additional 25% on earnings attributable to TSB above $10 million.

• Indexation: Both the $3 million and the new $10 million thresholds will be indexed to the Consumer Price Index in increments of $150,000 and $500,000 respectively.

• Realised earnings approach: In most cases, tax will be calculated on a fund’s realised (taxable) earnings, attributed to members with high balances, aligning with existing income tax concepts.

• Integrity measures: Subject to transitional provisions, the Bill includes integrity measures that will prevent members avoiding Division 296 tax on realised gains by withdrawing to reduce their TSB to below $3 million by the end of a year.

• Deferred start date: The reforms will now commence from 1 July 2026 instead of 1 July 2025.

The Bill also includes important transitional provisions to ensure Division 296 tax will only apply to capital gains accrued on assets post the intended start date of the legislation on 1 July 2026.

Latest articles

Indexation of the General Transfer Balance Cap from 1 July 2026

Following the recent release of the December quarter CPI figures, the General Transfer Balance Cap is set to increase from $2 million to $2.1 million on 1 July 2026.

This article examines the implications of the increased Transfer Balance Cap (TBC) for those who have already commenced a retirement phase income stream, as well as those planning to commence one for the first time.

Reversionary ABPs - transfer balance cap vs total super balance

When an account based pension (ABP) automatically reverts, a credit does not arise in the reversionary beneficiary’s transfer balance account until 12 months after death.

However, the balance of the account based pension is reflected in the reversionary beneficiary’s total superannuation balance from the next 30 June following death, which may impact their situation from the start of the next financial year.

SMSF - Central management and control test

|

Latest webinars and podcasts

FirstTech podcasts

Earn CPD points by staying up-to-date, listening to our podcasts and taking the quiz.

Our experts are always here to help

"It is truly refreshing to receive such a high-quality response demonstrating professional and technical competency. I hold FirstTech in high regard."

Norman Howe

Stratxa Advisory

"FirstTech is an asset to CFS and a valuable resource to advisers"

Jesmond Azzopardi

Tribel Advisory

We're here to help

Get in touch

For adviser services contact us 8:30am - 6pm (Sydney time) Monday to Friday.

FirstTech: 9am - 5:30pm Monday to Friday.

¹ Wealth Insights Platform Service Level Reports - CFS First Tech team was rated #1 by Wealth Insights for Technical Support every year since 2013.

Adviser use only. Information on this webpage is provided by Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 and Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468. It may include general advice but does not consider anyone’s individual objectives, financial situation, needs or tax circumstances. You should read the relevant Product Disclosure Statements (PDSs), Investor Directed Portfolio Service Guides (IDPS Guides) and Financial Services Guides (FSGs) before making any recommendations to a client. The PDSs, IDPS Guides and FSGs can be obtained from www.cfs.com.au or by calling us on 13 18 36. Past performance or awards are no indication of future performance.