Suggested Search

Know the facts about buying property through super before you make a move.

Summary

Thinking about using your super to invest in property? You’re not alone. Australians are increasingly seeking alternatives to traditional investments such as shares and managed funds to build their retirement wealth. Find out if buying property with superannuation is right for you.

Like podcasts? You'll love this article, now in audio.

Skip the scroll and listen to the audio summary at home, on the go, or wherever you are.

Buying property with SMSFs: how does it work?

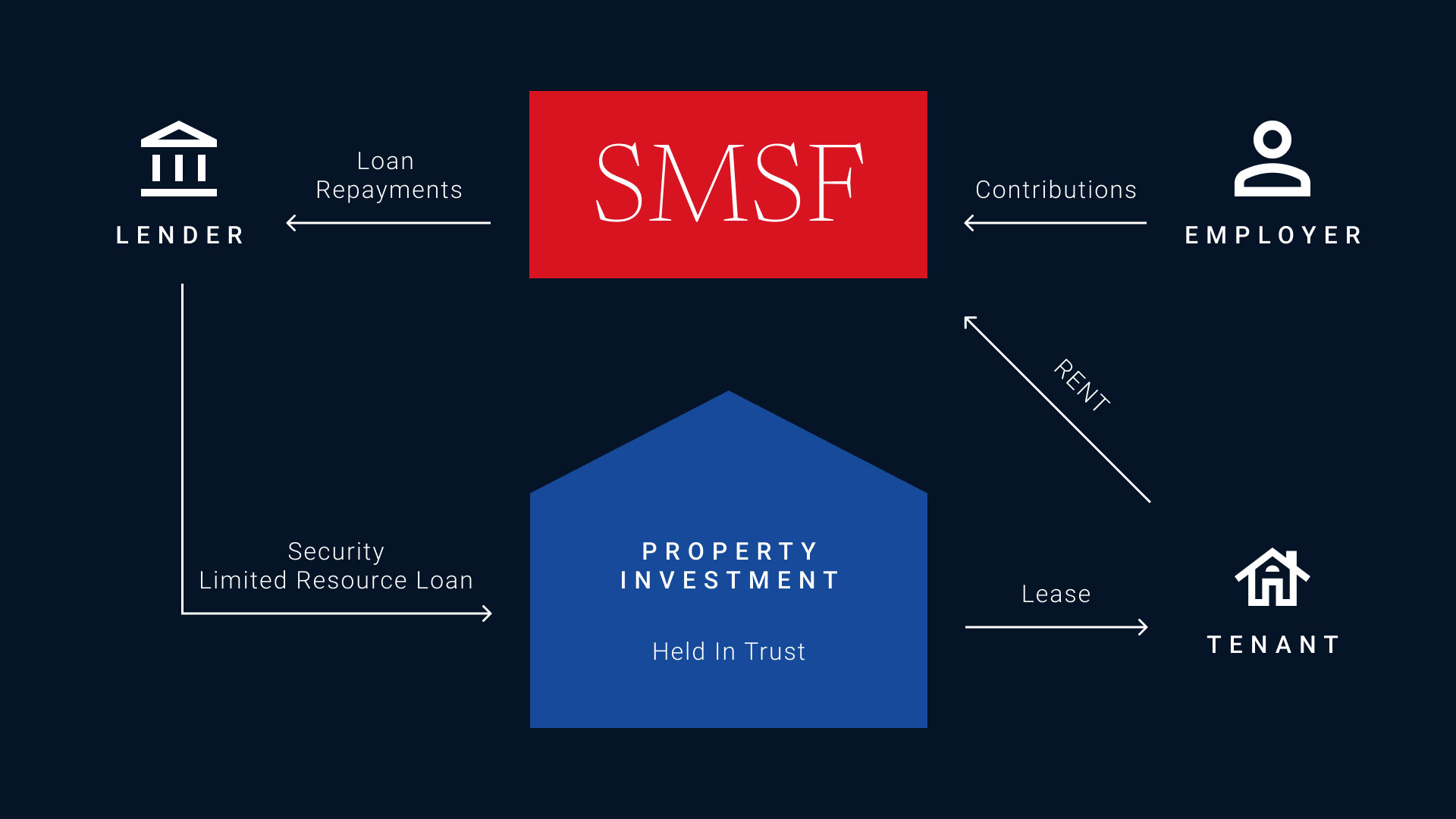

Investing in property through a self-managed super fund (SMSF) involves using your super savings to purchase residential or commercial property within the fund.

Many investors need to borrow additional money to make this possible. This can be done by setting up a special borrowing arrangement and complying with a strict set of rules. Once your fund has purchased a property, it will then become part of your retirement portfolio.

SMSFs can appeal to Australians who may want more control over their investments, access to alternative asset classes like cryptocurrency, or an early start in the property market.

However, buying property with super isn’t as simple as transferring money from your super into a regular home loan. There are strict rules, legal requirements, and risks you need to consider.

Things to think about before you start

- Setting up an SMSF: To buy property with your super, you’ll need to set up and run an SMSF. This means you become the trustee, responsible for managing the fund and following all the legal rules.

- Legal obligations: SMSFs have strict compliance requirements. These include keeping records and lodging audited annual returns.

- High cost of entry: Property is expensive. You may need a large super balance or use special borrowing arrangements, which can be complex and costly.

- Investment risk: Putting all your super into one property can expose you to the risks associated with property value declining. Diversification, or not putting all your eggs in one basket, can help reduce risk.

- Borrowing risks: Borrowing (gearing) may boost your returns, but it can also increase your losses if the property value falls.

- Returns: Make sure the property’s expected returns match your retirement goals.

- Penalties: SMSF rules can be tricky to navigate and breaking them can result in significant fines.

SMSF property loan borrowing

Buying property through your SMSF often means borrowing money, because most people don’t have enough super to pay for a property outright. Notably, super funds generally can’t borrow for investment purposes unless it’s through a Limited Recourse Borrowing Arrangement (LRBA).

An LRBA lets your SMSF take out a loan to buy a single asset, like a property on a single title, while limiting the lender’s rights if the fund defaults. This means the lender can only claim the property purchased under the loan, not the SMSFs other assets.

Key points to know:

- Strict conditions apply: The property must be held in a separate trust, and the loan can only be used to buy that property.¹

- Single title rule: The property usually needs to be on one title.

- Complex setup: You’ll need to create a company and trust structure. A lawyer or your accountant may be able to help with this.

- Costs and risks: Borrowing adds interest and fees, and gearing can magnify losses as well as gains.

- Compliance is critical: An LRBA has many requirements. Breaching these rules can result in penalties, and possibly even a forced sale of the property.

Borrowing through an LRBA can help you access property sooner, but it’s complicated and comes with risks. If you're going down this path, you should consider getting professional financial advice to support your investment strategy.

How to set up a property investment in your SMSF

Investing in property with a borrowing arrangement takes time. You'll need to take a number of steps before you even start inspecting properties.

Here’s a basic guide.

- Review your fund's investment strategy and trust deed to make sure the governing rules allow you to borrow, and to invest in property.

- Talk to your accountant or financial adviser to create a trust structure, set up a sole purpose company, and act as a trustee.

- Find a lender that offers LRBA loans and get a loan approval.

- Arrange to purchase a property in the name of the LRBA trustee company.²

- Obtain the required insurance.

- Pay transaction costs like stamp duty.

- Arrange for the property to be leased out at market rates.

Once your SMSF owns the property, you’ll need to manage it just like any other landlord. That means finding tenants, collecting rent, paying expenses, and keeping the property insured. Importantly, you generally can’t lease the property to yourself, your family, or any related parties. The only exception is if it's being used wholly, and exclusively, for business purposes.

Case Studies: Investors weigh up using their super to invest in property

John and Sarah use their super to break into the property market

John and Sarah are in their mid-40s with $1.2 million in combined super. They have strong financial knowledge and experience. Their goal is to invest in property and borrow through a Limited Recourse Borrowing Arrangement (LRBA). They’re comfortable taking on trustee responsibilities and have time to manage the fund.

An SMSF might suit them because:

- It gives access to direct property, something traditional funds don’t offer.

- Their high balance makes the costs worthwhile.

- Pooling their savings and using LRBA gives them more control and flexibility over their retirement strategy.

Their financial knowledge and experience means they can manage both their SMSF and the borrowing arrangement confidently.

Margaret considers the costs and risks - and decides to walk away.

Margaret is 60 with $150,000 in super. She considered using her super to buy an investment property through an SMSF. She liked the idea of control and flexibility, but after consulting a financial adviser, she realised the downsides.

She has limited investment knowledge and wants a simple, low-effort solution. She already has insurance through her current fund and doesn’t want the extra responsibilities of running an SMSF.

An SMSF possibly isn’t suitable for Margaret because:

- Her balance is likely too low to cover setup and ongoing costs like audits and compliance.

- She doesn’t want trustee duties

- Her goals can likely be met by staying in a large fund with insurance benefits.

Can I live in my SMSF property when I retire?

It's possible, but only after you retire and transfer the property out of the SMSF into your personal name. You generally can’t live in a property owned by your super fund.

It’s important to note there are some very complex legalities surrounding this move. Purchasing a property with super that you plan to live in when you retire may breach rules like the "sole purpose test".

For this reason, you should look to purchase a property consistent with the fund's investment strategy. It should allow all members to achieve their retirement income objectives.

As always, professional financial, tax, and legal advice, is recommended.

Getting financial advice for property investing through super

Investing in property through an SMSF is complex and comes with risks. It takes time and careful decision-making to keep your fund compliant.

Getting it wrong can severely impact your retirement wealth. The best way to reduce risk is by working with professionals who specialise in SMSFs. They can help you understand if this is the right move for you - helping you evaluate your financial situation, risk tolerance, and level of expertise.

That’s why Colonial First State offers financial advice options starting with options at zero cost. They range from comprehensive, ongoing advice with a financial adviser who specialises in SMSFs, to more general advice which can point you in the right direction.

Is an SMSF the right option for you?

Starting an SMSF isn’t for everyone. It requires careful consideration, commitment, and some financial expertise. Find out if it's the right move for you, and how we can help support your goals.

Related articles

¹ The loan can also be used to pay for expenses incurred in connection with the borrowing or acquisition, or in maintaining or repairing the asset (but not to improve the asset).

² We strongly recommend professional advice is obtained to ensure the property to be acquired complies with the strict LRBA requirements as well as the superannuation investment rules.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.