Suggested Search

Why choose Colonial First State?

Strong performance

We’re committed to helping you achieve your financial goals by focusing on strong performance1 and offering a wide range of investment choice.

Low admin fees

We have one of the lowest super admin fees in the industry, so you’ll pay less in fees and watch your future grow.2

Dedicated support

If you’re planning for the future or thinking about retirement, our guidance consultants can help you find the advice option that suits you.

Award-winning products and service

Strong performance backed by expert service is why we’re consistently awarded.

Open an account in minutes

Join super

Take control of your financial future. Let us manage your super with our top performing Lifestage option3 or you can build your own.

Start investing

Over the last 10 years, more than 10 of our investment options delivered annualised double-digit returns.4

Begin your retirement

Our members are much more likely to feel financially prepared for retirement compared to the general population.5

Who are we?

We're an award-winning super, retirement, and investment company that has helped more than 3 million Australians.

● Over 35 years of helping Australians build a better financial future.

● One of the largest pension payers in Australia, outside of the government.6

● We offer a wide range of investment options to suit every type of investor.

Who are we?

We're an award-winning super, retirement, and investment company that has helped more than 3 million Australians.

● Over 35 years of helping Australians build a better financial future.

● One of the largest pension payers in Australia, outside of the government.6

● We offer a wide range of investment options to suit every type of investor.

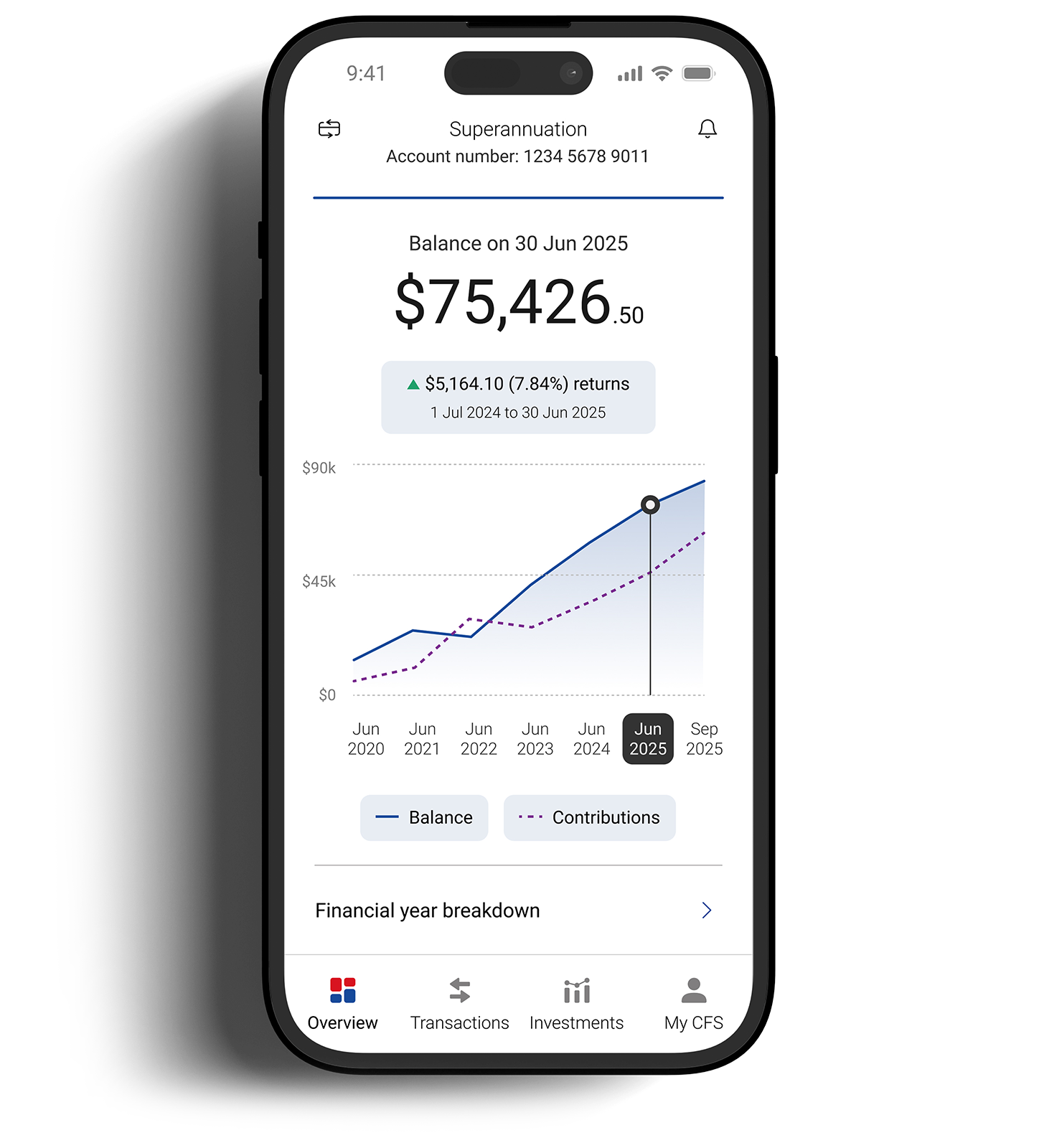

Easily manage your super and investments

The CFS App makes it easy to stay on top of your super and investments, wherever you are.

- Track performance with graphs and yearly breakdowns.

- Find what you need fast such as statements, transactions, and fees, all in the one place.

- Check your investments anytime with access 24/7.

- Stay updated with notifications sent straight to your phone.

Market Updates, News & Insights

Stay informed to help reach your financial goals.

Latest scams and alerts

Be scam aware - Stay one step ahead by checking the latest fraud and security alerts.

We're here to help

Get in touch

Get in touch with us online or call us 8:30am to 6pm (Sydney time) Monday to Friday.

Find the right advice option

Our dedicated team can help you choose from a range of different financial advice options.

Download mobile app

Track your balance and see your transaction history from anywhere.

* Chant West MySuper Performance Outcomes Survey for FY25. CFS was recognised by Chant West as having delivered the two highest overall investment outcomes to 30 June 2025 over 1, 3 and 5 years compared with all other MySuper products when aggregating the experience of all age cohorts.

¹ a) Source: CFS Research & Performance data as at 30 April 2025 for options in FirstChoice Wholesale Investments. Past performance is not a reliable indicator of future performance.

b) CFS MySuper Lifestage is a top performer over 1, 3 and 5 years for growth and balanced options based on the SuperRatings Fund Crediting Rate Survey 31 March 2025. Returns greater than one year are annualised and are net of fees and costs (excludes member fees).

² Super fund average admin fees are based on the Chant West Super Fund Fee Survey at 31 March 2025 that compares average fees by segments and across four investment risk categories. Administration fees of FirstChoice Wholesale Personal Super options (excluding FirstRate options) for a member balance of $50,000, is 0.20% p.a. It does not take into consideration investment fees and costs or transaction costs. Please see the PDS for these fees and costs.

³ CFS MySuper Lifestage is a top performer over 1, 3 and 5 years for growth and balanced options based on the SuperRatings Fund Crediting Rate Survey 31 March 2025. Returns greater than one year are annualised and are net of fees and costs (excludes member fees). Past performance is not a reliable indicator of future performance.

⁴ CFS Research & Performance data as at 30 April 2025 for options in FirstChoice Wholesale Investments. Past performance is not a reliable indicator of future performance.

⁵ Rethinking Retirement Report 2025, page 10.

⁶ APRA Superannuation Fund-Level Superannuation Statistics June 2023.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.