Suggested Search

Australians believe time-savings and efficiencies are the top benefits AI offers when it comes to investing their money.

Summary

Australians believe AI can help them manage their money by simplifying everyday tasks and providing more timely, useful information. But as our latest research shows, most Australians want people making the investment decisions.

Nine in 10 Australians want people making or overseeing investment decisions about their money according to new research on the relationship between AI and investing¹, commissioned by CFS.

Most Australians have heard about AI – but despite its ability to process large amounts of data in seconds, not many trust it enough to let it take charge of their money, the study shows.

While 28% of people use AI every day, just 9% of Australians would be comfortable with AI determining their investment outcomes.

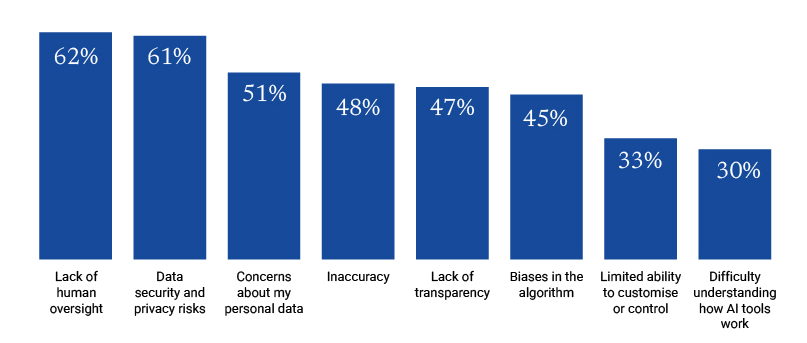

And only one in three (33%) trust the use of AI in the financial services industry, with many citing concerns around a lack of human oversight, transparency and accuracy as well as data security.

Top concerns about use of AI for managing money

Source: CFS research on AI and investments, conducted with more than 2000 Australians between July and September 2025.

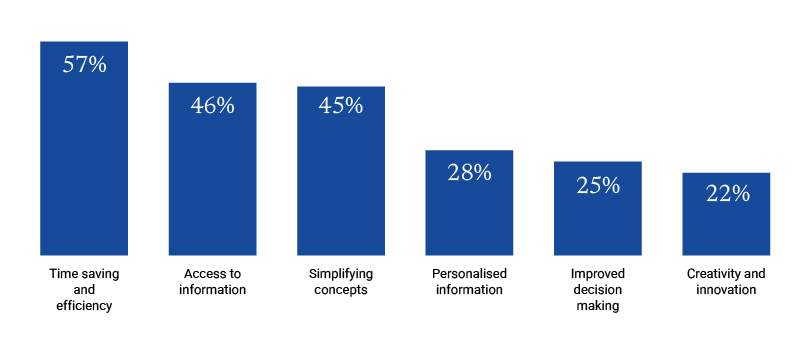

Time-savings are seen as the AI sweet spot

Australians believe time-savings and efficiencies are the top benefits AI offers when it comes to investing their money, nominated by 57% of respondents to our study.

That was followed by improving access to information and simplifying financial concepts.

Only one in four people (25%) expect it to improve decision-making, while 4% see no benefits at all – and this number increases to 10% among those aged over 60.

A significant minority believe AI can help reduce the risk of human error (41%) as well as automate routine tasks and better track market opportunities.

Top benefits of AI in investing

Source: CFS research on AI and investments, conducted with more than 2000 Australians between July and September 2025. Chart shows % of respondents to rank the benefit in their top three.

New ways AI can add value

While AI is increasing the speed at which investment professionals can access, analyse and respond to market data and information, the need for human judgment and differentiation remains, according to CFS Head of Equities Ben Lam.

“The big challenge is how quickly information gets reflected in price,” Ben says. “The pace at which events and information are reflected in share prices is extremely fast and getting faster.”

At CFS, AI is being used to complement and supplement our existing processes, but people remain firmly in the driving seat. Examples include building AI-powered agents to conduct repeatable tasks efficiently within established guidelines and with human oversight.

Ben says new ways in which AI can add value are emerging – such as uncovering investment opportunities that may have been overlooked due to the natural preferences that are part of being human.

“Everyone, whether they’re a portfolio manager or an analyst, has some inherent biases,” Ben says. “We have seen use cases where AI can be used to identify these preferences, which allows them to be corrected or reconsidered.”

Using AI to make money management easier

When it comes to their own relationship with their money, a significant minority of Australians – around four in 10 – believe AI can empower advisers and investment professionals to offer better advice.

In their own lives, people are most comfortable using AI in practical tools and everyday, low‑risk tasks that simplify money management, save time and improve outcomes.

These include:

- budgeting and personal financial management, such as categorising spend and spotting bill increases, nominated by 42% of respondents.

- product comparisons and insurance recommendations, including translating complex language into plain English (41%).

- banking alerts, such as flagging potentially fraudulent activity (38%).

- super management nudges, like contribution reminders, and fee or tax‑optimisation checks (33%).

- investment administration, including consolidating portfolio data, providing performance updates or market alerts, and suggesting tax or fee minimisation strategies (29%).

Younger people more receptive but concerns remain

In practice, most people still prefer human decision‑making or a human‑plus‑AI model when it comes to managing their money.

That said, our research shows Australians under 50, men and those who use it frequently already are more open to automated help with money decisions.

People who already have a financial adviser also use AI more often and are more comfortable with it.

But while two-thirds (64%) of Australians believe AI will be accepted in financial services within the next five years, at the same time, 23% believe it is a cause for concern.

In short, Australians are looking for practical tools to help them manage their money better, with AI assisting behind the scenes, humans in charge, and outcomes they can see in their super and investment statements.

Need super advice? It’s now included within your CFS membership

Tailored simple super advice from a qualified advice professional.

What's next?

Retirement calculator

Find out how much income you could receive in retirement

Personalised performance on the go

Know how your money performed wherever you are by logging into the CFS mobile app.

Find an investment to suit you

Compare our more than 200 super and investment options and returns – all in one place.

¹ CFS research on AI and investing conducted with more than 2000 Australians between July and September 2025.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.