Suggested Search

Gold, often used to help protect the value of money in times of uncertainty, has been trading at record highs despite some volatility.

Summary

With gold continuing to trade at high prices this year, albeit with some volatility, we examine the outlook for this traditional ’safe haven’ investment.

Whether you’re looking to diversify your investment portfolio, counter unpredictable geopolitical or fiscal conditions, chase growth – or all of the above – gold remains a hot topic among investors in 2026.

It’s been hard to miss the surging demand for gold in recent times. Over the two years to 26 January 2026, the price of gold – based on the ‘spot price’ at which it may currently be bought and sold – has risen sharply¹.

Gold prices eased briefly at the end of last year, but the precious metal climbed again in late January to new highs, breaking USD$5000 (approximately AUD$7,230) per ounce for the first time. It then traded even higher for a few days before the price dipped back below USD$5000¹.

However, as gold prices depend solely on demand, it can be volatile – as the variation in the gold spot price in recent weeks has shown.

Price of gold makes big gains

Source: Factset. Gold spot price in USD per ounce from 31 January 2025 to 30 January 2026.

Why invest in gold?

Over time, gold has shown a tendency to hold its value and rise during periods of global uncertainty, with many investors viewing it as a long term portfolio stabiliser.

Gold is often used to help protect the value of money, such as when inflation is high and when economic conditions weaken – such as during the global financial crisis, which began in 2008, and the COVID-19 pandemic of 2020 (see charts below).

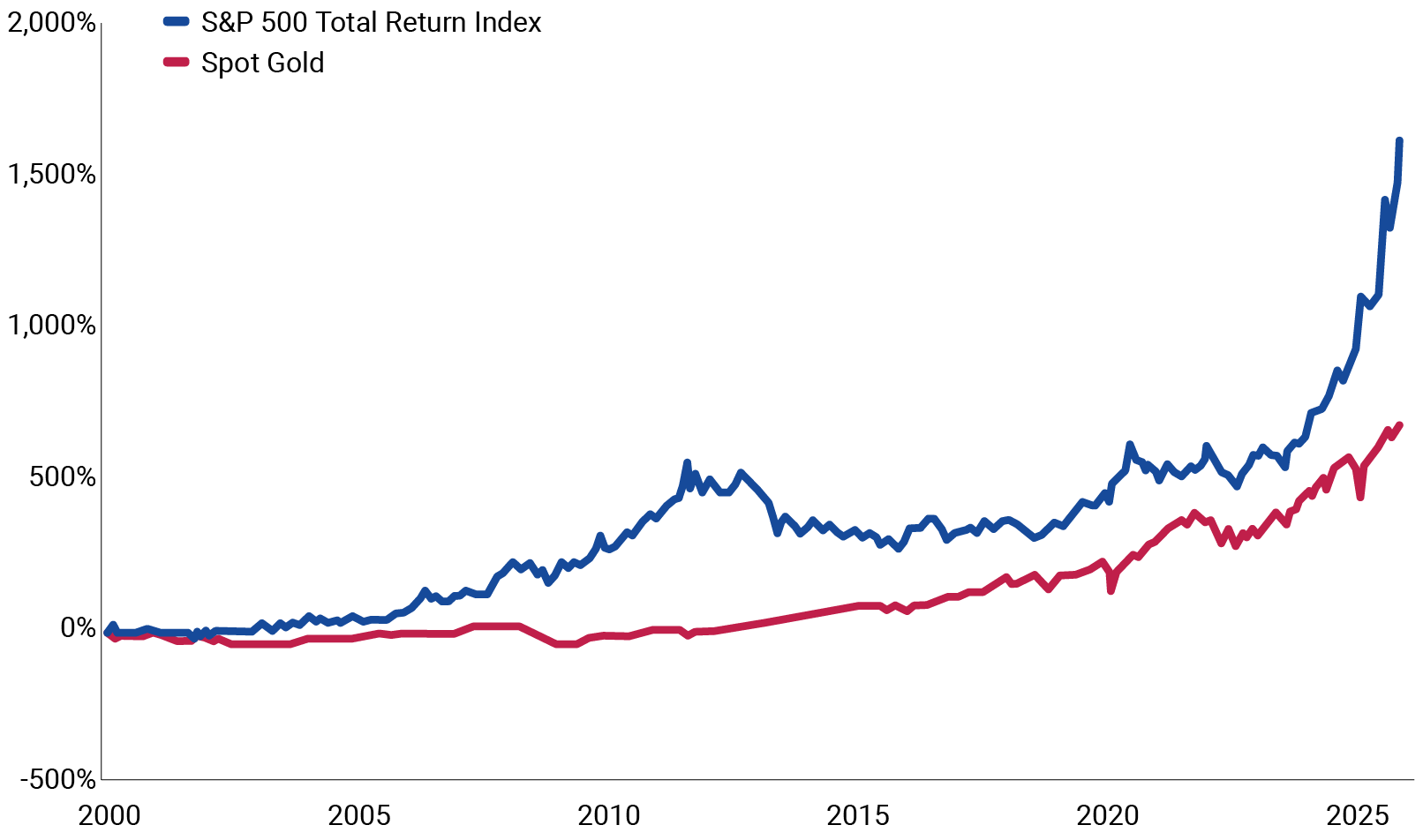

Gold returns outperform US stocks

Sources: Bloomberg, S&P. Data normalised with percentage appreciation as of 31 December 1999. S&P 500 Total Return Index is calculated intraday by S&P based on the price changes and reinvested dividends.

The current wave of demand for gold is broad-based, driven by increased buying from central banks, the Chinese retail market, western markets and exchange traded funds³.

“All investors are concerned with protecting or growing the purchasing power of their money,” says Peter Labrie, Executive Director of the FirstChoice investment platform at CFS.

“Investing in growth assets like shares are a really important part of that – but when stock markets are at record highs, gold can provide diversification,” Peter says.

“People have tended to buy gold in times of high inflation, political instability, loose fiscal policies, sky-high stock markets and falling bond prices,” he adds.

However Peter cautioned that as gold doesn’t produce a yield, or make valuable products and services, it depends on investor demand and sentiment, which can be difficult to predict.

“Whether these conditions continue to prevail is anyone's guess,” he says.

How to invest in gold

Investors typically invest in gold by buying:

- physical gold, such as gold bars and coins, or jewellery. While it’s a very tangible way to invest in gold, it requires safe storage, transport and insurance to protect your investment.

- gold backed ETFs and managed investment options. These offer exposure to the gold price without the need to store bullion. While fees apply, they offer ease of access and liquidity, or the ability to buy or sell quickly. In the case of the CFS Physical Gold option, it can also be monitored easily within your CFS investment account.

- gold related shares. The value of gold mining companies may rise alongside gold price rises. However, miners’ share prices may also be influenced by individual operating costs, debt levels, and market sentiment.

Tip: Australian small caps outperform

Investment options focused on smaller Australian companies, or ‘small caps’, benefited from their collective exposure to gold in 2025, outperforming bigger Australian companies over the year to 31 December 2025. The S&P/ASX Small Ordinaries – which tracks those included in the S&P/ASX 300 index of companies, but not in the S&P/ASX 100 – showed a 25% calendar year return in 2025. While smaller companies are often more volatile, they offer investors another way to tap into rising gold prices, according to CFS Head of Equities Ben Lam. “Gold is now one of the largest sectors,” he says. The S&P/ASX Small Ordinaries index lists Materials, which includes gold miners, as its dominant sector.

CFS Physical Gold option turns three as gold shines

CFS customers who invested in our gold option, CFS ETF Exposure Series – Physical Gold, since its inception just over three years ago, have been among those to benefit from the growing demand for gold.

The option is growing rapidly as some CFS customers seek investment types that aren’t reliant on equity or bond markets for returns.

“Gold still represents a small percentage of customers’ investments on the FirstChoice platform,” Peter says.

"But thanks to the increasing customer interest in gold and strong growth in values, CFS ETF Exposure Series – Physical Gold is certainly proving to be one of our fastest-growing investment options, with close to $300 million now invested in just three years."

Over the 12 months to 31 December 2025, our gold option – which invests in an exchange traded fund and aims to track the gold price before taxes and fees are deducted – delivered net returns of 50.7%², while annualised net returns since inception in November 2022 were 31.3%².

“Most customers investing in the CFS ETF Exposure Series: Physical Gold are using it as a satellite allocation as part of a diversified portfolio,” Peter adds.

“Advisers and customers make use of the FirstNet and CFS App to keep an eye on their investment allocations and can use the facilities that auto-rebalance regularly to stay within their target weights.”

Whether gold is right for any individual investor depends on your goals, your risk profile, and your broader investment mix.

As always, diversification remains key. Gold can play a helpful role as part of a balanced, long‑term investment strategy.

Find a fund

Learn more about CFS ETF Exposure Series – Physical Gold and our other investment options with our Funds and Performance tool.

Related articles

Past performance is not a reliable indication of future performance.

¹ Source: Bloomberg, XAU:CUR gold spot price, 25 January 2026.

² Source: Source: CFS Funds and Performance data. Net returns are calculated after deducting fees and costs.

³ Source: Bloomberg Television, ‘Gold rises past $4,700 to record’, 21 January 2026.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.