Suggested Search

Sharemarkets continued to make headlines in the 2024-25 financial year, but the best performers for investors seeking high returns broadened to include a much wider range of investment types.

Investors looking for strong returns were able to find them in a growing number of investment categories over the 2024-25 financial year as several investment types dramatically outperformed their 10-year average performance.

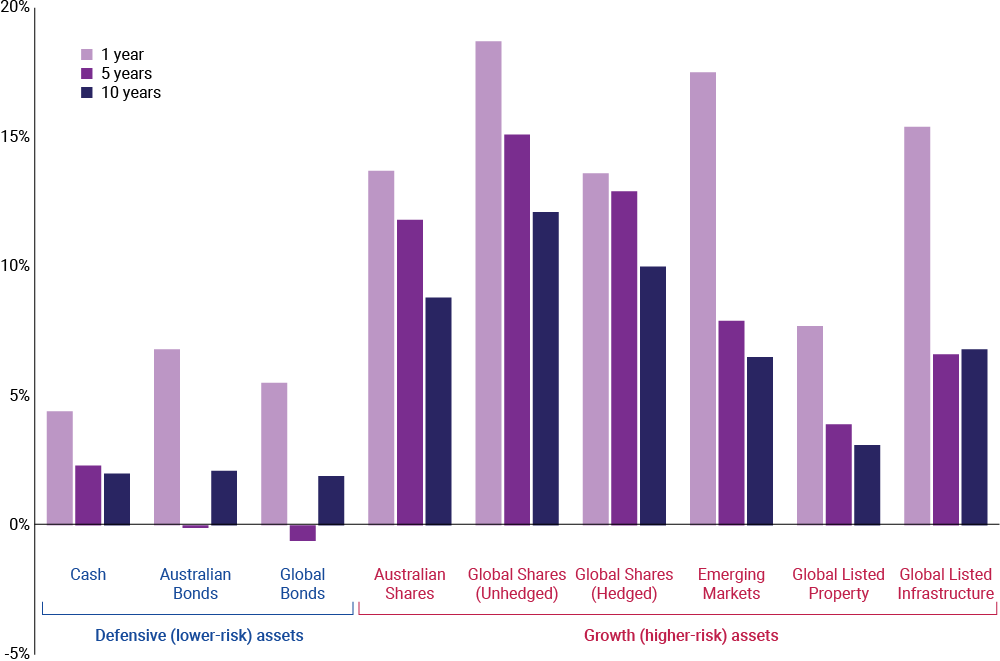

Unhedged global shares – which may be affected by fluctuations in the currencies used to conduct the trades – were the top performer in the year to 30 June 2025, delivering a return of 18.7%. This was only slightly less than their 2023-24 financial year return of 19.3%, despite increased market volatility, and remained well above their 10-year average return of 12.1%.

However, emerging markets, listed global infrastructure and even Australian bonds were among the highest returning asset types, delivering big gains compared with both the previous financial year performance, and their historical averages.

The results were revealed in market data showing how different investment types performed over the financial year to 30 June 2025*. They demonstrated the resilience of sharemarkets despite changed global trading conditions following the US government’s decision to implement widespread tariffs on imported goods.

However, they also revealed that investors seeking high returns were less dependent on the tech-led and AI-driven companies that fuelled performance growth in 2023-24, as other asset types showed dramatic improvements.

Best investment performers included established and emerging asset types

Among the star performers of the past financial year, emerging markets returned 17.5% for the 12 months to June.

This was a big improvement on the 12.2% they generated in 2023-24, and close to triple their average 10-year return of 6.5%.

Listed global infrastructure made a sharp gain in 2023-24, delivering a return of 15.4%. This was a six-fold improvement on the 2.4% return it delivered during the 2023-24 financial year, marking a spectacular turnaround with a performance that was well above its 10-year average of 6.8%.

And Australian bonds returned 6.8% last financial year – more than three times their 2.1% average return over 10 years.

Investment market performance over 2024-25, 5 years and 10 years*

Strong investment returns across the board

All major investment types outperformed their 10-year average returns during the 2024-25 financial year, the performance data shows.

Australian shares returned 13.7% during 2024-25, significantly better than their 11.9% return during the previous financial year and well above their 8.8% historical return.

Hedged global shares provided a return of 13.6%, down from the heady 19.8% growth they offered in 2023-24 but well above the 10.0% they delivered over 10 years.

Even low-risk asset types, such as global bonds, delivered returns more in line with the traditional returns of ‘growth’ investment types.

Global bonds provided a return of 5.5% - well above their 10-year average return of 1.9%, while cash delivered 4.4% growth – the lowest of all but more than double its 10-year average.

Performance backs diversification of investments

Strong investment returns across the board show that key contributors to investment growth broadened in 2024-25, as CFS Chief Investment Officer Jonathan Armitage foreshadowed last year.

Jonathan said diversifying investments to include emerging markets, smaller listed companies, income-paying shares, and other asset types such as private credit all contributed to CFS’s strong investment performance in 2024-25.

He said a broad range of investment types helped to create resilience in investment portfolios despite the expected continuation of global market turbulence and uncertainty.

“This very much speaks to what we've been trying to do with our investment portfolios, which is continuing to diversify the building blocks that we use,” Jonathan said.

What’s next?

We're here to help

Get in touch

Get in touch with us online or call us 8:30am to 6pm (Sydney time) Monday to Friday.

Find the right advice option

Our dedicated team can help you choose from a range of different financial advice options.

Download mobile app

Track your balance and see your transaction history from anywhere.

* Benchmark performance annualised for periods greater than one year is shown for: Bloomberg AusBond Bank Bill Index; Bloomberg AusBond Composite 0+ Yr Index; Bloomberg Global Aggregate AUD Hedged; S&P/ASX 300 Accumulation Index; MSCI ACWI Ex-Aus Index Special Tax Net AUD Unhedged; MSCI ACWI Ex-Aus Index Special Tax Net AUD Hedged, MSCI Emerging Markets (AUD), FTSE EPRA/NAREIT Dev ex Aus Rental Index AUD Hdg Net and FTSE Dev Core Infrastructure Index AUD Hdg Net.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments. This webpage may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.