Suggested Search

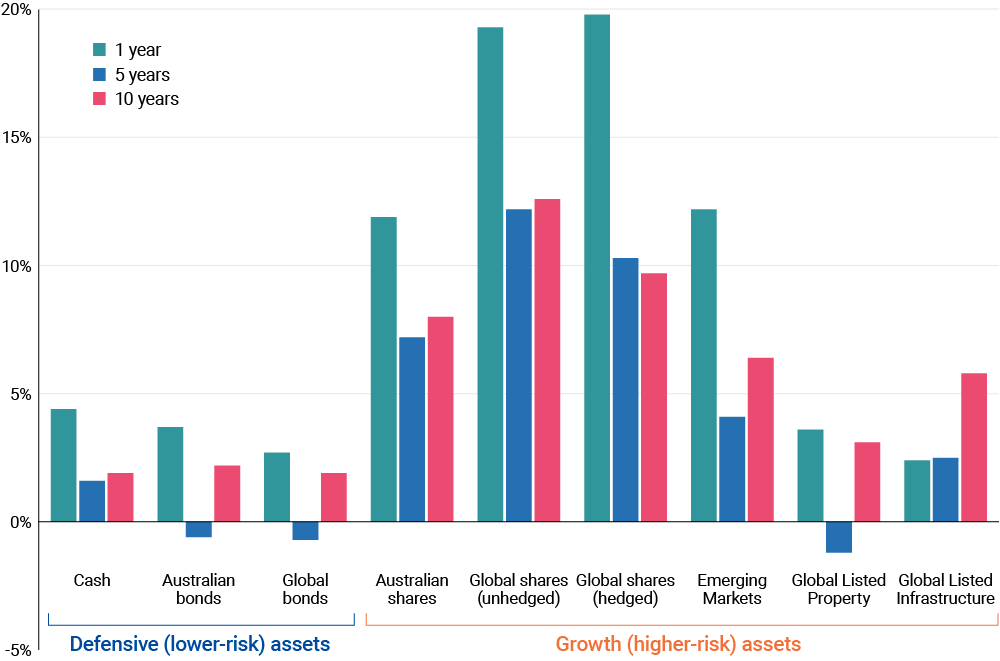

Global and local shares were the top-performing investment sectors of the past financial year, but new opportunities are emerging with markets and inflation expected to remain volatile.

Global shares, led by tech stocks and AI, helped investors who were willing to invest in higher-risk assets realise returns of close to 20% in financial year 2023-24.

Hedged global shares, which minimise the effect of currency fluctuations, returned 19.8% over the year to 30 June 2024, while unhedged global shares returned 19.3%.

The results are revealed in market data showing how different investment sectors performed over the financial year to 30 June.*

Investment market performance over 2023-24, 5 years and 10 years

Source: Colonial First State Research and Performance. Annualised performance for periods over 12 months.*

US tech stocks and Australian shares led the way

US tech stocks, including AI darling Nvidia, Microsoft, Google parent company Alphabet and Facebook parent Meta performed well for investors, particularly CFS members, according to CFS Chief Investment Officer Jonathan Armitage.

“Nvidia was a core holding but we also invested in a range of other big tech stocks that performed very well for investors,” Jonathan said.

Australian shares, which returned 11.9% over the year, also performed strongly. Big mining stocks, such as BHP, and digital infrastructure and property group Goodman helped boost results for CFS members.

Local and global shares significantly outperformed their average returns over the past 10 years, the data shows; Australian shares averaged 8% over the past decade, while unhedged global shares returned 12.6% and hedged global shares offered investors 9.7%.

Emerging markets, which bounced back strongly over the course of the past year, were up 12.2%. This was almost twice the 6.4% average return from emerging markets for the previous decade.

Jonathan said CFS would look to increase its exposure in some emerging markets because of lower sharemarket valuations.

“We are looking to expand our investments in markets such as South Korea, China and Taiwan,” Jonathan said. “Our focus has been more on the valuation benefits that come from some of those Asian markets rather than some of the more volatile, commodity-related economies such as Brazil.”

Global listed infrastructure, and global listed property which reported aggregated figures of 3.6%, were the lower performing asset types among traditional ‘growth’ assets – meaning they may offer higher rewards but often also carry higher risk.

Global listed infrastructure, with returns of 2.4% for the full year, was the only investment category to end the year well down on its 10-year average growth of 5.8%.

Global listed property had been showing negative returns of -3.0% at the six-month mark but finished the year up 3.6%.

Low-risk investments outperform some growth assets

Some low-risk types of investment beat global listed property and infrastructure over the full year.

Cash returned 4.4% thanks to higher interest rates. This was more than twice its 10-year average return of 1.9%.

Jonathan said inflation data is expected to continue to be volatile, which is likely to keep interest rates higher for longer.

Australian bonds returned results of 3.7%, well up on the 2.2% average return they offered over the 10-year term, while global bonds also performed relatively strongly with a return of 2.7% for 2023-24.

“The returns from fixed income were very low just a few years ago,” Jonathan said. “Now, the returns are materially higher from investment-grade, high-yield credit.”

Investment opportunities for 2024-25

There has been a “broadening out” of the drivers of investment performance over the past six months, Jonathan said, which was a good sign for the year ahead.

“US consumption has probably surprised on the upside,” he said. “European consumption has been more robust than people might have expected as well. So that has meant the impact of rising interest rates has probably been less than expected on spending habits. That’s fed through to generally stronger economic data coming out of the US.

“There has been a big difference between the performance of large companies and smaller companies and I think that’s because a lot of people expected a recession, certainly in the US, and that impacted smaller company valuations. We see the potential to continue to diversify our exposure there.

“The returns from private debt continue to be very interesting and there are structural drivers behind the continued growth in private debt in North America and across Europe, as well as here in Australia.

“We think inflation data will continue to be volatile and therefore diversification across all our building blocks in the portfolio will continue to be the thing we’ll focus on.”

What’s next?

We're here to help

Get in touch

Get in touch with us online or call us 8:30am to 6pm (Sydney time) Monday to Friday.

Find the right advice option

Our dedicated team can help you choose from a range of different financial advice options.

Download mobile app

Track your balance and see your transaction history from anywhere.

* Source: Colonial First State Research and Performance. Annualised performance for periods over 12 months. Benchmark performance is shown for: Bloomberg AusBond Bank Bill Index; Bloomberg AusBond Composite 0+ Yr Index; Bloomberg Global Aggregate AUD Hedged; S&P/ASX 300 Accumulation Index; MSCI ACWI Ex-Aus Index Special Tax Net AUD Unhedged; MSCI ACWI Ex-Aus Index Special Tax Net AUD Hedged, MSCI Emerging Markets (AUD), FTSE EPRA/NAREIT Dev ex Aus Rental Index AUD Hdg Net and FTSE Dev Core Infrastructure Index AUD Hdg Net.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments. This document may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.