Seven in ten Australian retirees say they are comfortable in retirement with the amount of money they have saved, according to new research conducted by CFS.

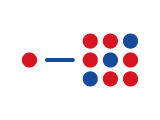

But if you live in Brisbane, you are more likely to be enjoying your retirement, according to the CFS Rethinking Retirement report.

Two in three Brisbane retirees (69%) told us they were enjoying retirement, just shading the proportion of happy retired Sydneysiders (68%).

Brisbane

69

Sydney

68

Melbourne

60

Adelaide

54

Perth

52

Source: CFS Rethinking Retirement report, for which 2247 Australians were interviewed between Oct and Dec 2023.

While more than half of Perth’s retirees said they were enjoying themselves, the proportion that was satisfied with their situation was markedly lower at 52%.

East-coast dwellers were more likely to be happy with their lot, although Melbourne underperformed cities in warmer climes.

This was despite Melbourne outranking its counterparts when it comes to liveability in general, according to The Economist’s most recent annual quality of life index. In that study, released in June 2023, Victoria’s capital was ranked the third most liveable city in the world, one place ahead of Sydney.

Many retirees were surprised by the freedom they had to travel and remain active in their later years, according to the study, for which 2,247 Australians (including 430 retirees) were surveyed between October and December 2023.

However, the definition of ‘comfortable’ varied significantly between respondents.

“Food, petrol and a roof over my head,” was how one retiree described it. “Having enough money to take an overseas trip every few years without having to save all the time,” was the view of another.

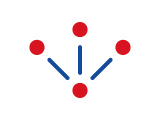

Australians overwhelmingly want flexibility and choice in retirement, with less than one in three of those who had not yet retired planning to stop working completely at the current retirement age of 67.

The most popular work preferences beyond retirement age were reduced working hours, followed by a desire to continue working the same hours, and pursuing a passion project with less pay and fewer hours.

Of those who were already retired, two in three stopped working out of necessity, rather than when they wanted to.

Some simply liked to work and were unable to get a job as a senior employee, while others were made redundant.

Seven in eight believe they should be able to work for as long as they think is necessary.

The most common reasons Australians retired unexpectedly was due to their own or their partner’s poor health.

Eight out of ten Australians want the flexibility to access their retirement savings if they need it, while half were had a natural fear of running out of money.

Some said they had been impacted by cost of living and health issues, with one in two Australians at or above retirement age worried about falling ill and rising healthcare costs.

Three in four planned to leave some super behind for their loved ones.

“The cost of buying a house is beyond reach for younger people now,” said one respondent. “A little help from me when I die might help pay off their mortgage and allow them to retire at an appropriate age.”

Whether Australians had received financial advice appeared to be a key factor in their perception of their own retirement.

Our research found unadvised Australians are twice as likely as advised Australians to find retirement harder than they expected.

Over three-quarters of advised retirees say they are currently enjoying retirement compared to just half of those who have never received advice.

These responses underline the importance of planning early and getting financial advice.

Get in touch with us online or call us

8:30am to 6pm AEST Monday to Friday.

Our dedicated team can help you choose from a range of different financial advice options.

Track your balance and see your

transactions history from anywhere.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. This document may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.