Suggested Search

When markets move, it’s tempting to retreat to cash and wait for the dust to settle. But many of the share market’s best days occur when markets wobble. We examine some myths around whether staying in the market beats moving to cash in turbulent times.

Heard the one about how the best thing to do in times of market turbulence is to take all your money out of financial markets and put it in the bank? You can always buy back in later, when markets go up, right?

Sounds like a plan – until you realise that markets move rapidly in both directions, and many of the share market’s best growth days occur in bear markets, or when a market has dropped sharply over a short period.

Put simply, this means that if you try to time the market, by switching to low-risk investments such as cash in the bank when markets are fluctuating, your investments are unlikely to grow as quickly as if you had just remained invested.

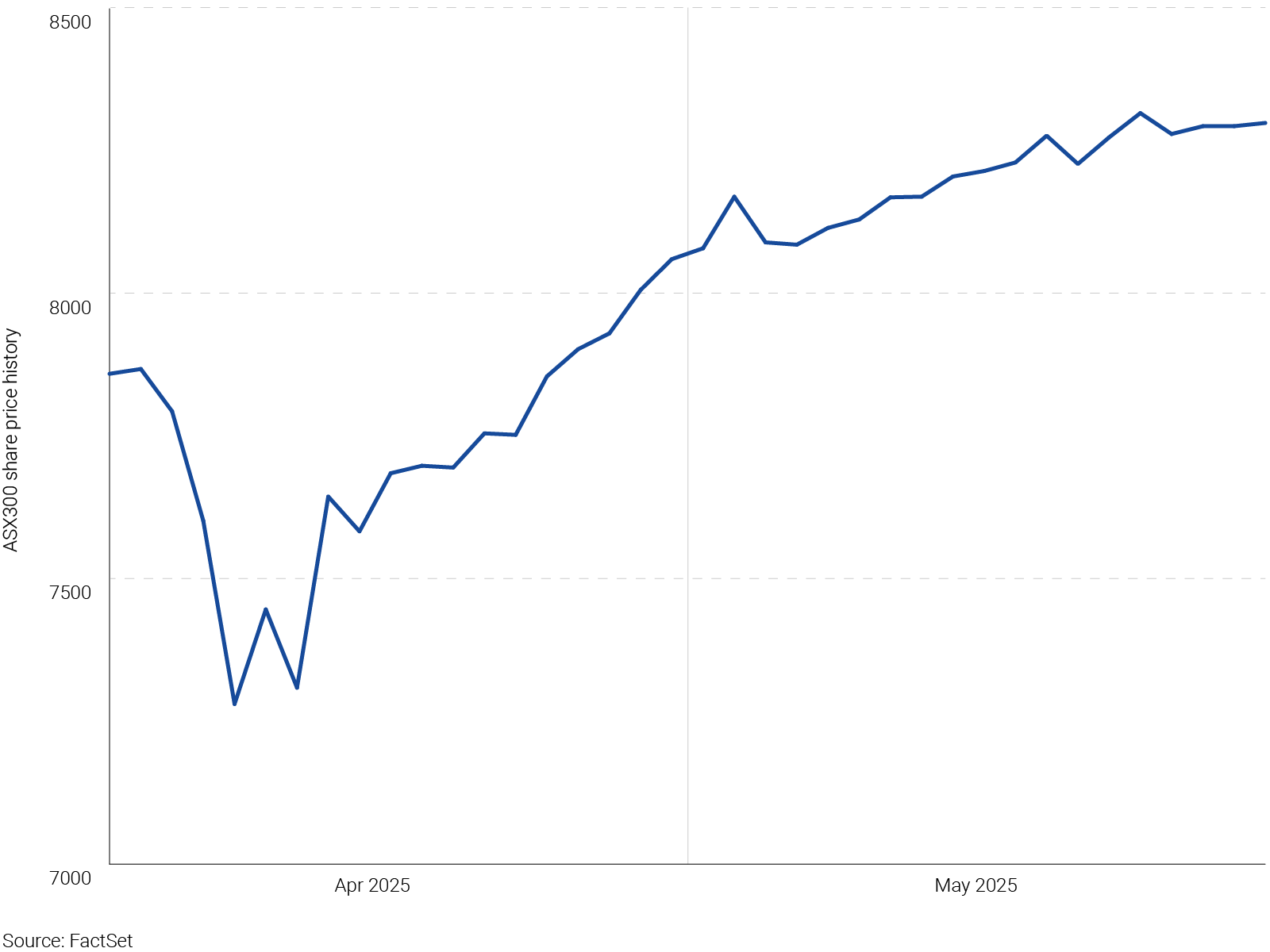

This year, on 3 April, sharemarkets in Australia and around the world fell sharply after US President Donald Trump announced tariffs on all imported goods.

As the chart below shows, the Australian sharemarket bounced back quickly and share prices recovered lost ground just a few weeks later.

How the Australian sharemarket rebounded after April’s tariff falls

If you switched out of shares during the market fall, and kept your money in cash, you might have missed out on significant growth.

Investors who held the course and stayed invested through April and May would have benefited from an 8-9% rebound from the lows at the start of April and another 3-4% in May.

So let’s look at a few of the myths that do the rounds when markets move.

Myth 1: Volatility means the market is falling

It’s understandable to feel nervous when markets are fluctuating. But volatility simply refers to the degree of variation in share or asset prices over time.

It doesn’t always mean the market is falling – prices can swing up as well as down. In fact, some of the most volatile days in market history have included upwards and downwards movement. This is normal market behaviour.

Reacting emotionally to short-term dips can lead to poor timing decisions. Investors who stay the course often benefit from the market’s eventual recovery.

Myth 2: You should move to cash when markets are uncertain

While moving to cash might feel safe, and it may limit your losses and provide peace of mind, it can be risky in the medium to long term.

Timing the market – trying to sell before a drop and buy before a rise – is notoriously difficult, even for professional investment analysts.

Missing just a few of the market’s best days can significantly reduce your returns. But staying invested ensures you’re in the market and can benefit when those rebounds occur.

One strategy you might consider is to keep a cash reserve on hand, but also ensure you have money invested to grow.

Myth 3: Volatility is always bad

Volatility can create opportunities. For long-term investors, market dips can be a chance to buy quality assets at lower prices.

What’s important is remembering your investment goals, the level of risk you’re prepared to accept, and the timeframe over which you can invest. Your investing strategy should guide you, even when markets wobble.

For example, if your usual strategy is to save $50 a month to invest, while it may feel counter-intuitive to continue to invest when markets are moving around, you’ll benefit from the long-term trend: which is that over time, markets tend to grow.

Ups – and downs – are part and parcel of investing. History shows us that over the long term, markets tend go up. It’s easy to forget this when times are good, as well as when markets are more volatile. That’s why it’s important to stay the course, remember your strategy, and invest accordingly.

Need more help?

If you would like more help with your investment strategy, book a free consultation with our guidance team.

What’s next?

Still have questions? What to do

Book a call with our guidance team, or call us on 13 13 36, Mon-Fri, 8.30am-6pm AEST.

Staying calm when markets move

Why it pays to stay calm in the face of short-term market uncertainty.

Market volatility for retirees

It's natural to feel concerned when markets are volatile. Here's what to know.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments. This document may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the Target Market Determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.