Suggested Search

Prepare your advice fee consent forms ahead of client meetings

You can now prepare an advice fee consent form - for both ongoing and fixed term adviser service fees - up to 120 days in advance of an upcoming meeting with clients.

Save a draft to work on

later

You can also save a draft version of your advice fee consent form in FirstNet Adviser and continue where you left off later.

Enhanced client consent management

• Tips to help avoid anniversary and consent date errors

• Clear instruction for obtaining and submitting client consent.

Dedicated dashboard to manage fees

Managing client fees doesn't have to be onerous. To help keep track of upcoming and expired Adviser service fees, we've created a dedicated dashboard that lets you search, organise and action your fees.

On the 'Manage Fees' dashboard, you can now:

- search for clients with existing Adviser service fee arrangements

- search by fee type (fixed term or ongoing)

- renew consent for an Adviser service fee with a consent date within the next 120 days

- view the existing Adviser service fee arrangements for clients with an expired consent date (last 30/31 days)

- download a csv file of the fee data.

Combined with the Adviser service fee pre-populated form and Adobe sign, which allows you to send advice fee consent requests to your clients digitally, it’s now far easier to stay on top of your client fees.

You can access the fee dashboard from either your main dashboard, or the 'My clients' or 'Fees' sections in FirstNet Adviser.

Simplifying the Adviser service fee consent process

Since the launch of our new advice fee consent tools in July, we've been listening to your feedback and we’re pleased to give you new flexible options for managing advice fee arrangements with your clients.

We've integrated Advice fee consent into FirstNet Adviser using Adobe Sign to save you and your clients time.

- Manage client consent for adviser service fees conveniently and quickly online

- Seamless experience for advisers and clients

- Reduced friction with straight through processing

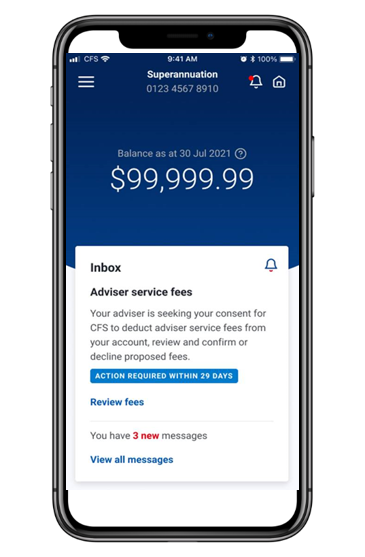

Advice fee consent requests delivered securely to your clients

Advice fee consent requests are now sent to your client in a new Communications inbox in FirstNet Investor and the CFS member app – where they can securely sign in, review and confirm or decline the request.

Simplified adviser service fee member consent declaration

We've simplified the Advice fee consent declaration on the digital form to align with the paper based Advice fee consent form, so it’s easier for your clients to understand.

Unleash in ways you never thought possible

Get in touch

For technical enquiries contact us

8:30am – 6pm AEST Monday to Friday.

Information on this webpage is provided by Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) and Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL). It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at www.cfs.com.au/tmd, which include a description of who a financial product might suit. You should read the Financial Services Guide (FSG) available online for information about our services. This information is based on current requirements and laws as at the date of publication.

Tax considerations are general and based on present tax laws and may be subject to change. You should seek independent, professional tax advice before making any decision based on this information.

AIL and CFSIL are not registered tax (financial) advisers under the Tax Agent Services Act 2009 and you should seek tax advice from a registered tax agent or a registered tax (financial) adviser if you intend to rely on this information to satisfy the liabilities or obligations or claim entitlements that arise under a tax law.