Suggested Search

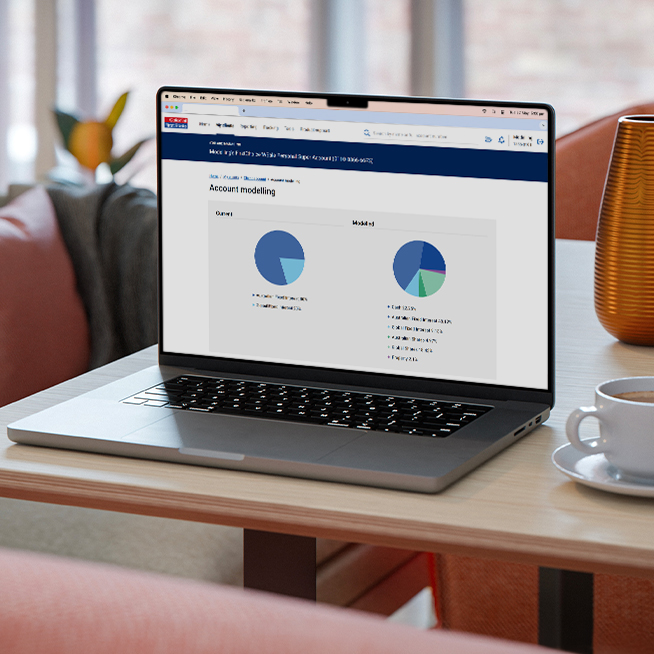

Key features

- Automatic pre-population of the client's current account details – including account balances, fee information, portfolio rebates and investment options.

- Easy comparison of portfolios including modelling of additional investments.

- Ability to export the output summary, detailing From, To and Total products, as part of your SOA/ROA.

Frequently Asked Questions

We're currently reviewing potential enhancements to our tool, including the possibility of incorporating buy/sell spreads. We’re waiting for additional feedback to better understand the demand and how best to integrate it.

At launch, the Modelling tool is only available to use for existing clients. If you would like to model for a new client, the FirstChoice manager and asset allocation calculator is still available.

You can export the output summary from the tool for your advice documents. At the end of the 'compare' page, there is a 'page print' functionality that allows you to generate a PDF version of the document for your use.

The portfolio rebate estimate is calculated using the current account balances for each of your client’s s eligible FirstChoice products. Eligible FirstChoice products included in the calculation of the rebate are:

- FirstChoice Wholesale Personal Super

- FirstChoice Wholesale Pension

- FirstChoice Wholesale Investments

- FirstChoice Investments

- FirstChoice Employer Super.

Investments in FirstChoice Employer Super, First Sentier Strategic Cash, CFS Enhanced Cash and the FirstRate investment options in any of the eligible FirstChoice products count towards the total portfolio balance eligible for a rebate, however no rebate is payable on amounts invested in those options and are counted first in each tier.

If a client holds multiple FirstChoice eligible accounts, the portfolio rebate is paid proportionately between accounts. For FirstChoice Wholesale Investments and FirstChoice Investments accounts where there are joint account holders, the modelling tool assumes the client that is being modelled or viewed is eligible for the portfolio rebate.

The below table details the portfolio rebate based on portfolio balances. Refer to the relevant PDS for further information.

$0 - $100,000

Nil

next $400,000

0.05%

next $500,000

0.10%

$1,000,000

0.20%

Please complete the survey available here for feedback on further enhancements.

Any questions?

Get in touch with your BDM to learn more or contact us on 13 18 36 today.

We're here to help

Get in touch

Get in touch with us online or call us 8:30am to 6pm AEST Monday to Friday.

Adviser use only

Information on this webpage is provided by Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 and Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468. It may include general advice but does not consider anyone’s individual objectives, financial situation, needs or tax circumstances. You should read the relevant Product Disclosure Statements (PDSs), Investor Directed Portfolio Service Guides (IDPS Guides) and Financial Services Guides (FSGs) before making any recommendations to a client. The PDSs, IDPS Guides and FSGs can be obtained from www.cfs.com.au or by calling us on 13 18 36. Past performance or awards are no indication of future performance.