Compare our super performance

Take a look at the performance of two of our CFS Lifestage options: CFS Lifestage 1965-69 (balanced) and CFS Lifestage 1975-79 (growth) in FirstChoice Employer Super against the median performance of balanced and growth options in the independently researched SuperRatings Fund Crediting Rate Survey.¹

CFS Lifestage 1965-69 vs Balanced options

1 year

12.27%

10.28%

3 years p.a.

13.41%

10.95%

5 years p.a.

10.05%

8.72%

10 years p.a.

8.18%

7.61%

CFS Lifestage 1975-79 vs Growth options

1 year

14.26%

12.07%

3 years p.a.

15.50%

13.24%

5 years p.a.

12.01%

10.49%

10 years p.a.

9.06%

8.79%

Source: SuperRatings Fund Crediting Rate Survey, September 2025. Past performance is not a reliable indicator of future performance.

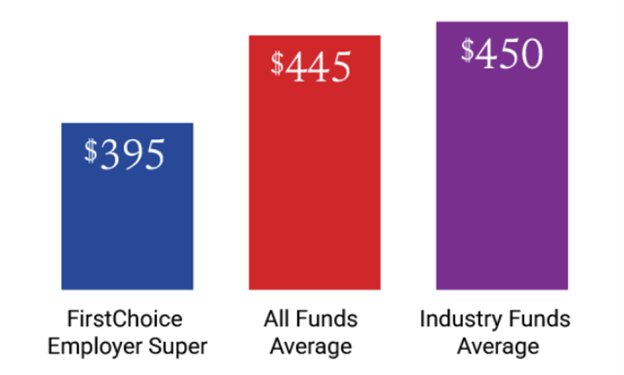

Compare our super fees

No one wants their investment returns whittled down by high fees and costs. That’s why FirstChoice Employer Super² has lower fees than the super fund average. Stay on top of your fees anytime by logging into the CFS App. Download the app today

This chart shows the annual fee of the CFS Lifestage 1965–69 option with a $50,000 balance in FirstChoice Employer Super is $395, compared to the All Funds Average of $445, and the Industry Funds Average of $450. Fees for FirstChoice Employer Super, the All Funds Average and the Industry Fund Average are compared for MySuper products based on data from the Chant West Super Fund Fee Survey. Fees may vary for other age cohorts, typically ranging between $375 and $400.

Source: Chant West Super Fund Fee Survey, September 2025.

¹ Performance data for CFS Lifestage 1975-79 and CFS Lifestage 1965-69 options in FirstChoice Employer Super is from the SuperRatings Fund Crediting Rate Survey. Returns shown are calculated after investment fees and costs, transaction costs and investment taxes, but before administration fees are deducted.

The super fund median returns of the balanced and growth options are from the SuperRatings Fund Crediting Rate Survey. SuperRatings classify growth options as 77%-90% growth assets and balanced options as 60%-76% growth assets.

Past performance is not an indicator of future performance.

² The fee comparison applies to MySuper products and is based on the CFS Lifestage 1965-69 option for a member balance of $50,000. Fees may vary for different age cohorts. The Chant West Super Fund Fee Survey compares the CFS Lifestage option that is closest to 71% growth assets, which is consistent with the average risk and return profile of most non-lifecycle products. Total fees and costs include administration fees and costs, investment fees and costs, and net transaction costs, calculated on a gross of tax basis. Fund averages are calculated by Chant West on a weighted average basis. This comparison has been prepared by CFS using data sourced from the Chant West Super Fund Fee Survey and is based on information provided to Chant West by third parties, that is believed accurate at the time of publication. Fees may change in the future which may affect the outcome of the comparison. Chant West may make adjustments to fees and costs for comparison purposes and therefore data may vary to other published materials. Whilst care has been taken to ensure that the data provided by Chant West is correct, CFS neither warrants, represents nor guarantees the contents of the information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein.

Disclaimer

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (AIL) is the trustee of the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and issuer of FirstChoice range of super and pension products. Colonial First State Investments Limited ABN 98 002 348 352, AFSL 232468 (CFSIL) is the responsible entity and issuer of products made available under FirstChoice Investments and FirstChoice Wholesale Investments.

Information on this webpage is provided by AIL and CFSIL. It may include general advice but does not consider your individual objectives, financial situation, needs or tax circumstances. You can find the target market determinations (TMD) for our financial products at https://www.cfs.com.au/tmd which include a description of who a financial product might suit. You should read the relevant Product Disclosure Statement (PDS) and Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to a financial adviser before making an investment decision. You can get the PDS and FSG at www.cfs.com.au or by calling us on 13 13 36.

Avanteos Investments Limited ABN 20 096 259 979, AFSL 245531 (referred to as Colonial First State, CFS, ‘we’, ‘us’ or ‘our’) is the Trustee of Essential Super ABN 56 601 925 435 and the issuer of interests in Essential Super. Essential Super is distributed by the Commonwealth Bank of Australia ABN 48 123 123 124, AFSL 234945 (the Bank). The CFS Group consists of Superannuation and Investments HoldCo Pty Limited ABN 64 644 660 882 (HoldCo) and its subsidiaries, which includes CFS. The Bank holds an interest in the CFS Group through its significant minority interest in HoldCo.

This information is issued by CFS and may include general financial product advice but does not consider your individual objectives, financial situation, needs or tax circumstances, and so you should consider the appropriateness of the advice having regard to your circumstances before acting on it. The Target Market Determination (TMD) for Essential Super can be found at cfs.com.au/tmd and includes a description of who the financial product is appropriate for and any conditions on how the product can be distributed to customers. You should read the Product Disclosure Statement (PDS) and the Reference Guides for Essential Super carefully and consider whether the information is appropriate for you before making any decision regarding this product. Download the PDS and Reference Guides at commbank.com.au/essentialsuper-documents or call us on 13 4074 for a copy.

None of the Bank, HoldCo, CFS, nor any of their respective subsidiaries guarantee the performance of Essential Super or the repayment of capital by Essential Super. An investment in this product is subject to risk, loss of income and capital invested. An investment in Essential Super is via a superannuation trust and is therefore not an investment in, deposit with or other liability of the Bank or its subsidiaries.